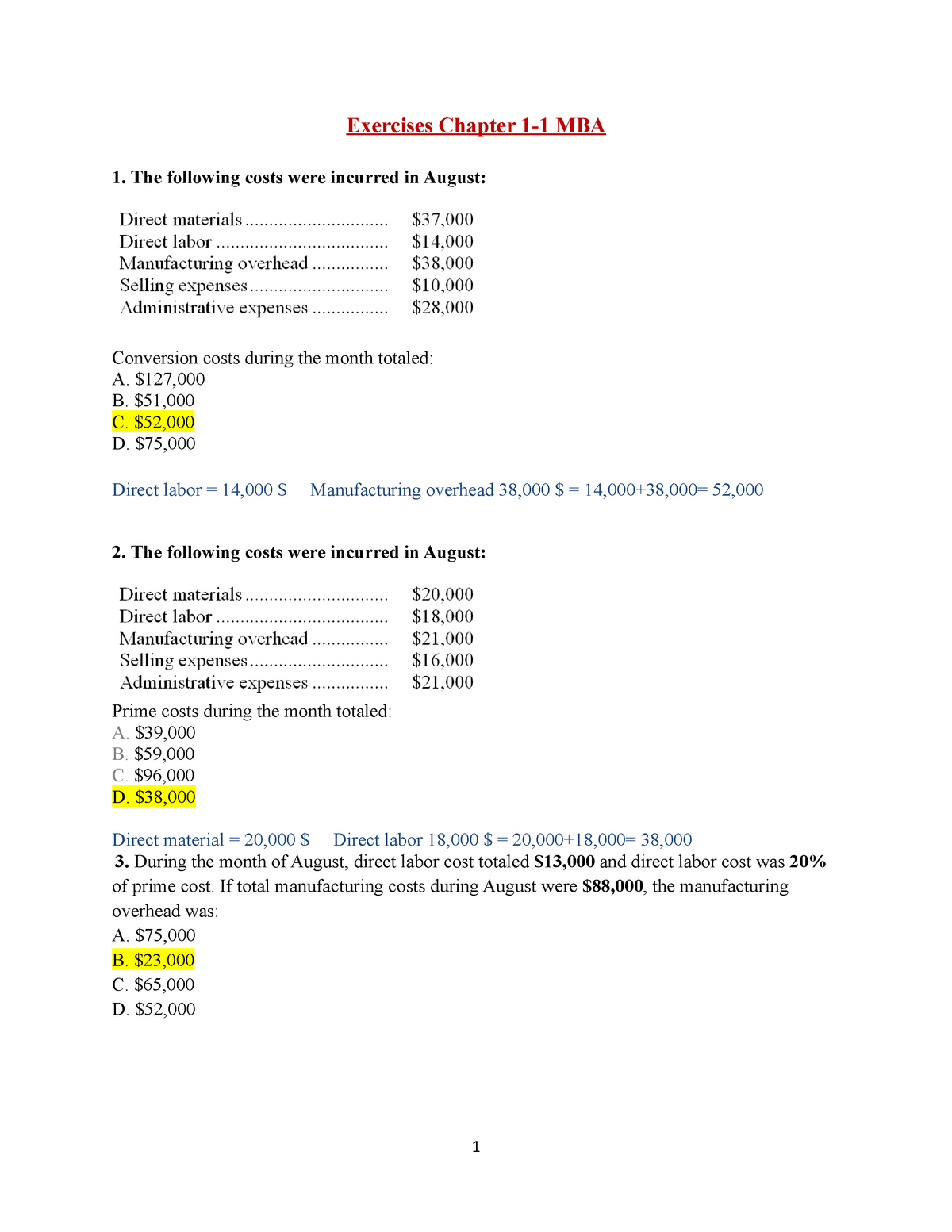

Factory Overhead Is 75 of the Cost of Direct Labor

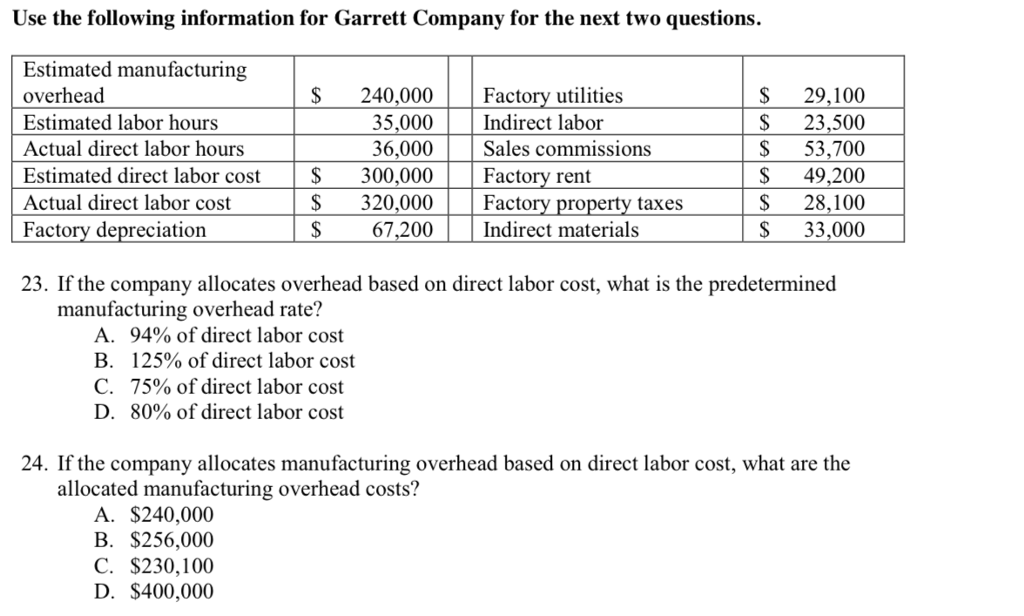

A third party has offered to make the engines for 60 per unit. Direct Labor Cost Method Uses the amount of direct labor cost that has been charged to the product as the basis for applying factory overhead.

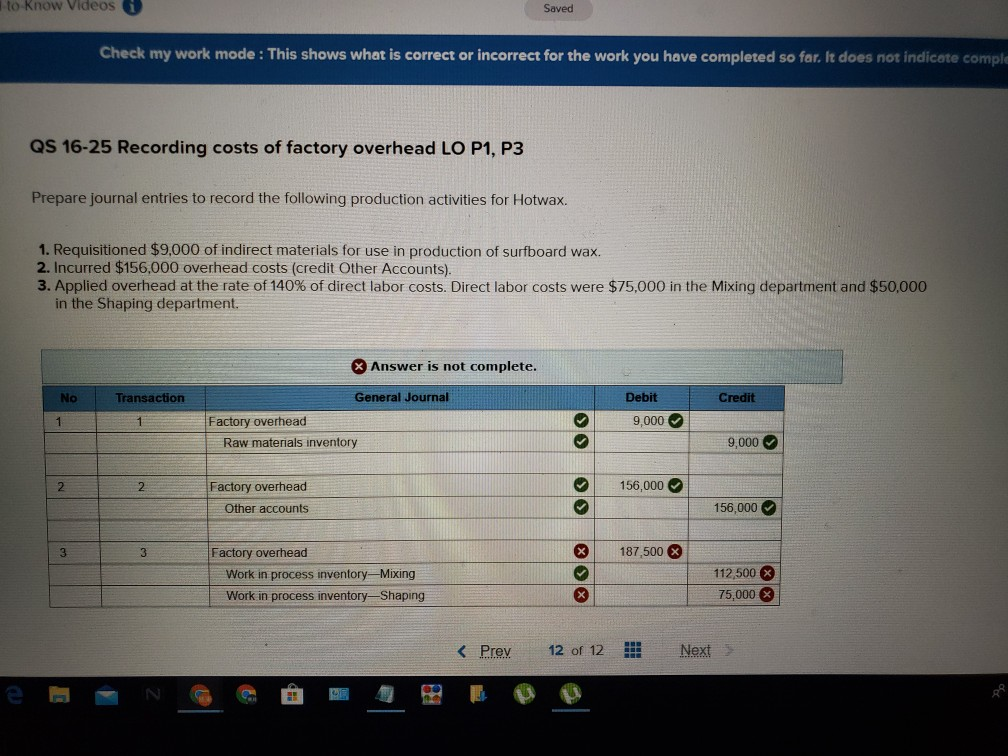

Solved Applied Overhead At The Rate Of 140 Of Direct Labor Chegg Com

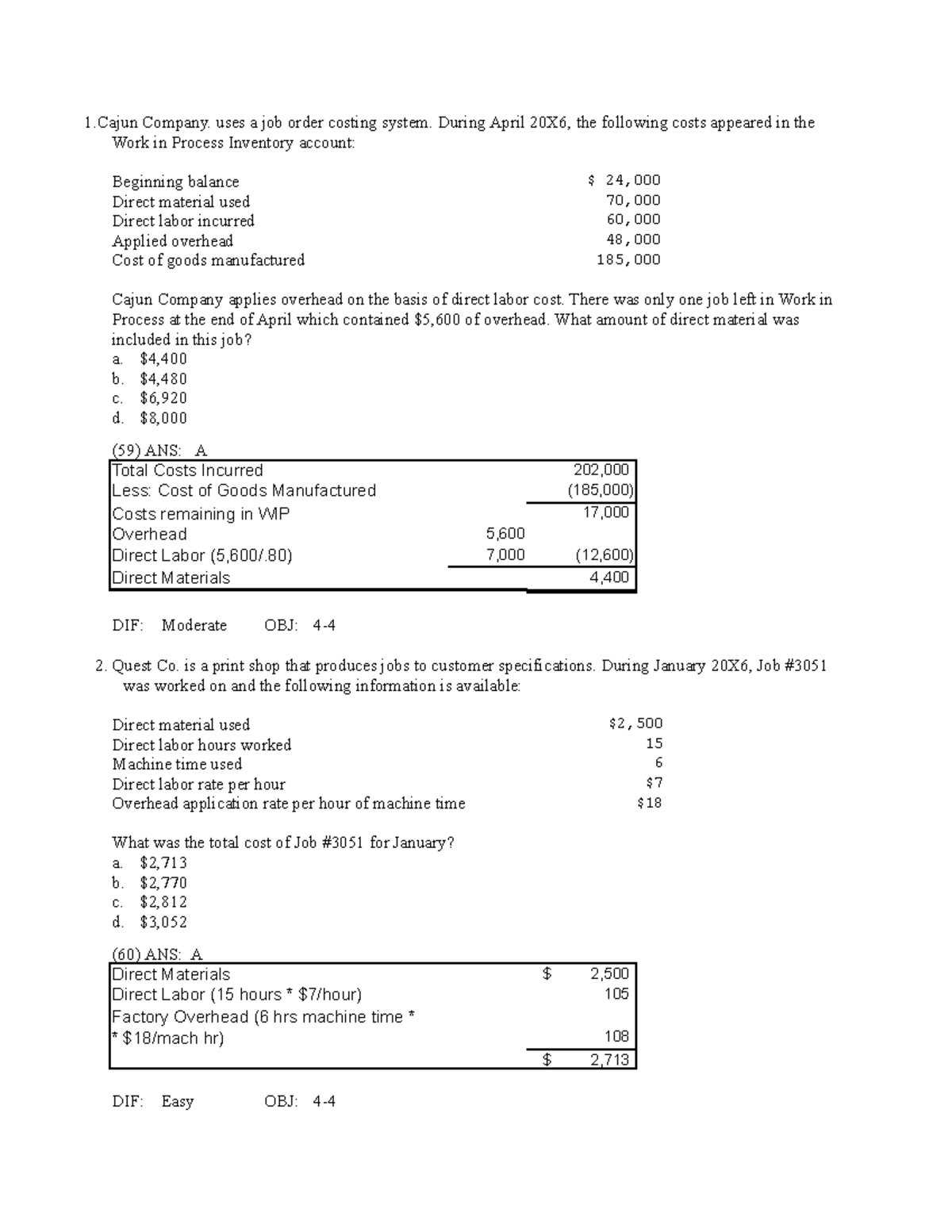

The 2000 units actually required 1580 direct labor hours at a cost of.

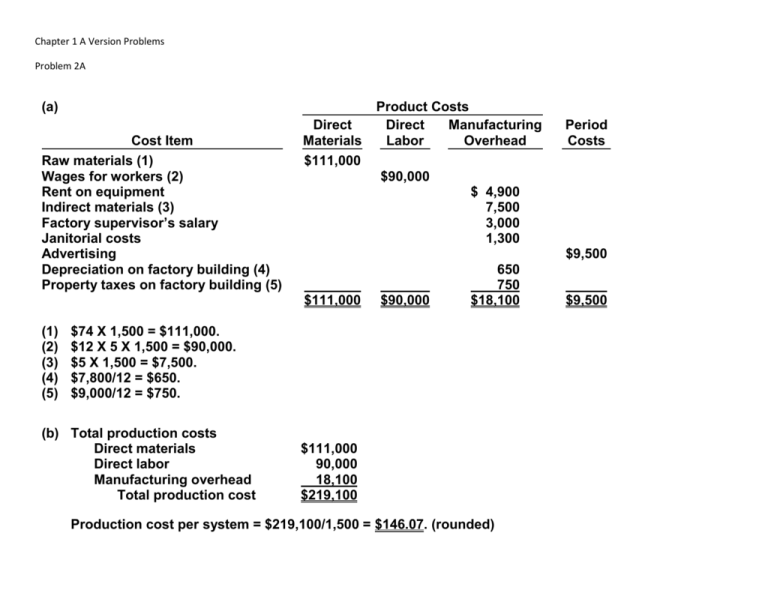

. Overhead costs as a percentage of value added in American industry and as a percentage of overall manufacturing costs have been rising steadily for. Examples of costs that are included in the manufacturing overhead category are as follows. Also assume that during the first month of operations Job 100 incurred Php1000 for direct materials and Php3000 for direct labor and that the job is completed by the end of the month.

Factory overhead is an example of a product cost. The unit manufacturing costs during the year were as follows. 280000 350000 80.

Fixed factory overhead 15. Work in process inventory January 1 2012 11000. Job 100 Direct materials 1000 Direct labor 3000 Factory overhead 50 of direct labor 1500 Total cost of completed job 5500.

The absorption costing method includes all costs related to production both fixed and variable. Direct materials used 27000. Factory overhead is 75 of the cost of direct labor.

During May the following transactions were recorded by the company. At 530 200800 lbs. Applies factory overhead to production at 75 of labor cost.

Fixed factory overhead is applied at 150 of direct labor cost per unit. Direct Materials Direct Labor and Factory Overhead Cost Variance Analysis Mackinaw Inc. It is charged to expense when the produced units are later sold as finished goods or written off.

Cost of goods manufactured Direct materials used Direct labor incurred Work in process inventory January 1 69000 30000 26000 13000 Factory overhead is 75 of the cost of direct labor. Smith Company reports the following information. Factory overhead 32000 x 75 Direct labor cost Cost of raw material used Add increase in raw material inventory Cost of raw materials purchased 24000 32000.

This means that for every dollar of direct labor Wallace will assign _______ of manufacturing overhead to a job80 cents. Smith Company reports the following information. Supplies not directly associated with products such as manufacturing forms Since direct materials and.

This overhead is applied to the units produced within a reporting period. Applied factory overhead for the year based On total manufacturing cost 27. Cost of goods manufactured based on actual direct materials and direct labor and applied factory overhead 970 Applied factory overhead to work in process based on direct labor cost 75.

The total manufacturing costs added during 2001 was P900000 based on actual direct materials and direct labor but with manufacturing overhead applied on actual direct labor pesos The manufacturing overhead applied to process was 72 of the direct labor pesos and it was equal to 25 of the total manufacturing costs. Dillon Company applies manufacturing overhead to jobs using a predetermined overhead rate of 75 of direct labor cost. Smith Company reports the following information.

The unit product cost is calculated using direct material direct. Direct labor cost and factory overhead cost. The costs of materials and labor that do not enter directly into the finished product are classified as factory.

The processing of a product requires a standard of 08 direct labor hours per unit for Operation 4-802 at a standard wage rate of 675 per hour. Work in process inventory on December 31 is O a. Any under or overapplied overhead cost is closed out to Cost of Goods Sold at the end of the month.

Cost of goods manufactured based on actual Direct materials and direct labor and Applied factory overhead 970 Applied factory overhead to work in process Based on direct labor cost 75. A company used 35000 of direct materials incurred 73000 in direct labor cost and had 114000 in factory overhead costs during the. Direct labor costs are included in the conversion costs of a product.

Beginning work in process inventory was 80 of ending work in process inventory. Factory overhead is 75 of the cost of direct labor. Variable factory overhead 12.

Factory overhead is the costs incurred during the manufacturing process not including the costs of direct labor and direct materials. Conversion cost is the combination of direct materials cost and factory overhead cost. Contains 4400 in direct labor cost.

75 of fixed factory overhead which represents executive salaries rent depreciation and taxes continue. In addition variable factory overhead is applied at 750 per unit. Direct labor incurred 25000.

Work in process inventory on December 31 is. May 1 2021 P 96200 132000 156000 May 31 2021 P 94600 148000 172000 Inventories Materials Work in process Finished goods Credit sales from January to May 2021 P500000 Credit sales from January to April 2021- P400000 Cash Sales for the. Cost of goods manufactured 68250 Direct materials used 27000 Direct labor incurred 25000 Work in process inventory January 1 11000 Factory overhead is 75 of the cost of direct labor.

The allocation of factory. Standard costs and actual costs for direct materials direct labor and factory overhead incurred for the manufacture of 78000 units of product were as follows. Work in process inventory on December 31 2012 is.

Manufacturing overhead is all indirect costs incurred during the production process. Factory overhead is normally aggregated into cost pools and allocated to units produced during the period. Cost of goods sold Add increase in finished goods inventory Cost of goods manufactured Add increased in work in process inventory Total manufacturing cost Less.

Standard Costs Actual Costs Direct materials 202800 lbs. Assuming that the company expects annual overhead costs to be 280000 and direct labor costs for the year to be 350000 compute the overhead rate. 13500 O b8500 O c.

Amounts to Php100000 and the estimated direct labor cost is expected to be Php200000. Applied factory overhead for the year based On total manufacturing cost 27. Processes a base chemical into plastic.

Cost of goods manufactured 68250 Direct materials used 27000 Direct labor incurred 25000 Work in process inventory January 1 11000 Factory overhead is 75 of the cost of direct labor. The predetermined overhead rate would be 50 of direct labor dollars Php100000Php200000. The following data are drawn from the companys records.

The vacuums sell for 150 each. Number of units 6400. Work in process inventory on December 31 is a.

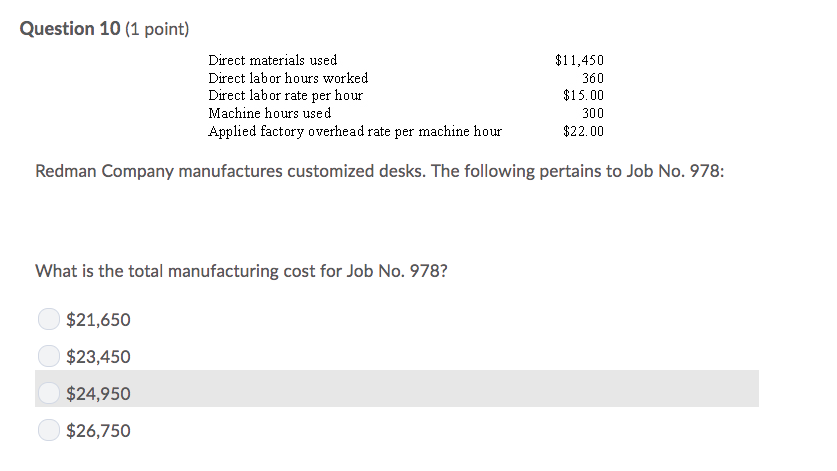

Solved Question 10 1 Point Direct Materials Used Direct Chegg Com

Solved Question 10 1 Point Direct Materials Used Direct Chegg Com

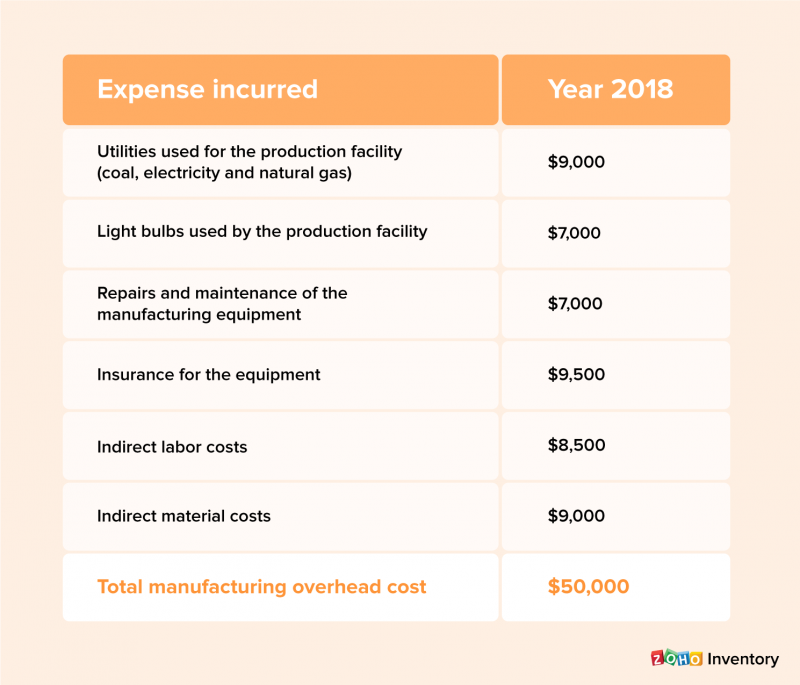

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Solved Manufacturing Overhead Costs Incurred Indirect Chegg Com

Solved Question 10 1 Point Direct Materials Used Direct Chegg Com

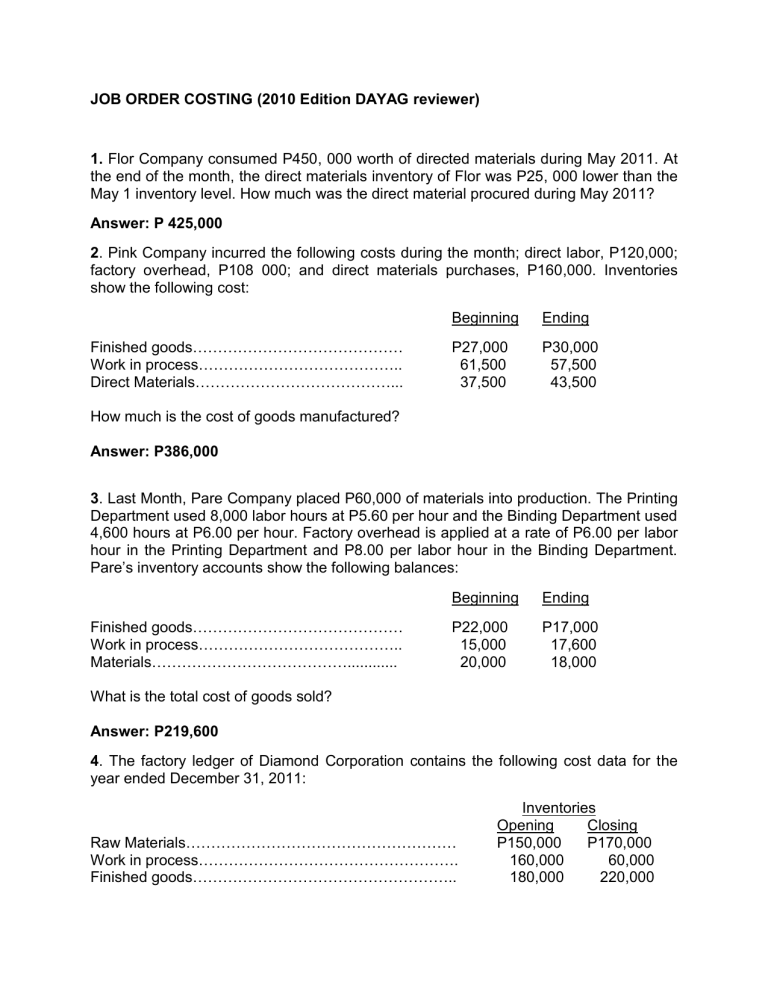

Toaz Info Joborder Dayag Musordocx Pr 5b133ce4495af62d27d3d5ba478f33c0

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

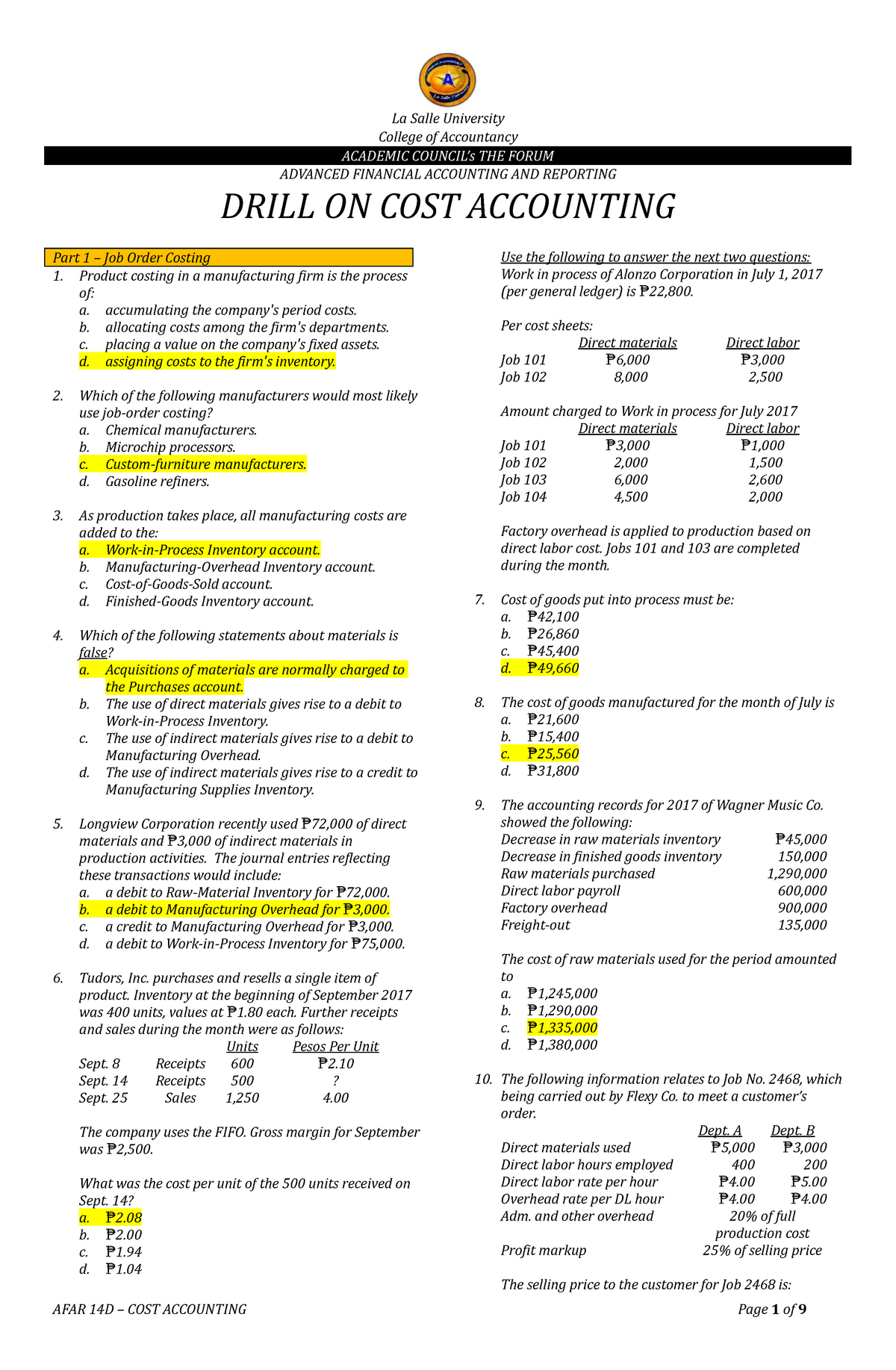

368489934 Afar 14d Cost Accounting Job Order Process Costing Jit Studocu

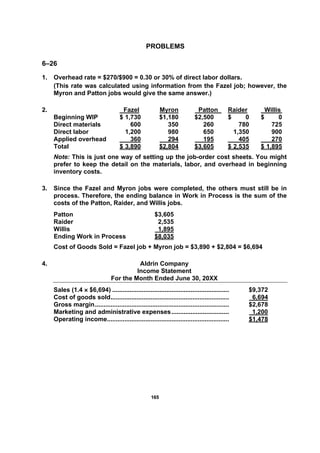

Chapter 6 Job Order And Process Costing

A Product Costs Cost Item Direct Materials Direct Labor

Factory Overhead Manufacturing Overhead Job No 1 Job No 2 Job No 3 Charge Direct Material And Direct Labor Costs To Each Job As Work Is Performed Ppt Download

A03 Lesson 8 Exam Answers Ashworth Exam Answer Exam Lesson

421266498 A04 Chapter 5 Job Order Costing Problems 1 Company Uses A Job Order Costing System Studocu

Exercises Ch 1 1 Mba Ass 2 Acc Of Managerial Decisions Ass 2 Studocu

Solved Question 1 25 Marks The Following Information For Chegg Com

Solved Use The Following Information For Garrett Company For Chegg Com

Solved Direct Materials Direct Labor And Factory Overhead Chegg Com

Comments

Post a Comment